The Big Squeeze

Feb 17 2026 • 10 mins read

2025 was a clear turning point for stablecoins. Globally, regulatory clarity arrived, and our core corridors—Ghana, Nigeria, South Africa, Kenya—got clear licensing frameworks for crypto. We've been building with the conviction that crypto is inevitable, that stablecoins are the future of money. The future we envisioned is arriving, and so is everyone else.

From above: incumbents with massive distribution—PayPal, Western Union, Flutterwave, Paystack— who have all announced stablecoin plays in the past few months. From below: hundreds of startups who are hungry for market share. And then there's us, sandwiched in the middle of what I've started calling "The Big Squeeze."

The platform effect

Platforms absorb complexity. They commoditize what once required significant time, capital, or specialized expertise, lowering barriers to entry. AWS absorbed the complexity of building, provisioning, and maintaining your own servers into a monthly bill. Stripe absorbed dozens of notoriously hard-to-acquire banking relationships and best-in-class payments expertise into an API call.

Stablecoins, as permissionless financial infrastructure, are absorbing the core of the traditional fintech stack. Instead of renting permissioned access from banks to closed networks, you build on open, programmable networks accessible to anyone with an internet connection. Instead of settling through correspondent banks—each with attendant fees, delays, and trust risk—you settle onchain in seconds.

For incumbents, stablecoins are additive to their strategic advantages. They already have distribution, brand trust, compliance depth and operational scale. Stablecoins provide a faster, cheaper rail for them to serve their existing customers—plus treasury efficiency since they can hold stablecoins instead of prefunding accounts in every currency.

For startups, the barrier to building fintech has never been lower. Stablecoins bypass the closed networks that previously required millions in capital and years of work. Every underserved market, every overlooked use-case, every demographic that's been ignored is now open for the taking.

The squeeze is on.

Sorry, Satoshi.

If anyone can build an African stablecoin neobank, how does Accrue differentiate? We're betting that value accrues to fast, reliable, and compliant fiat rails.

Stablecoin transactions are surrounded by fiat. The platform makes the middle easy, but the edges—getting money in and out, managing liquidity, FX risk, KYC/AML—are where most products will die.

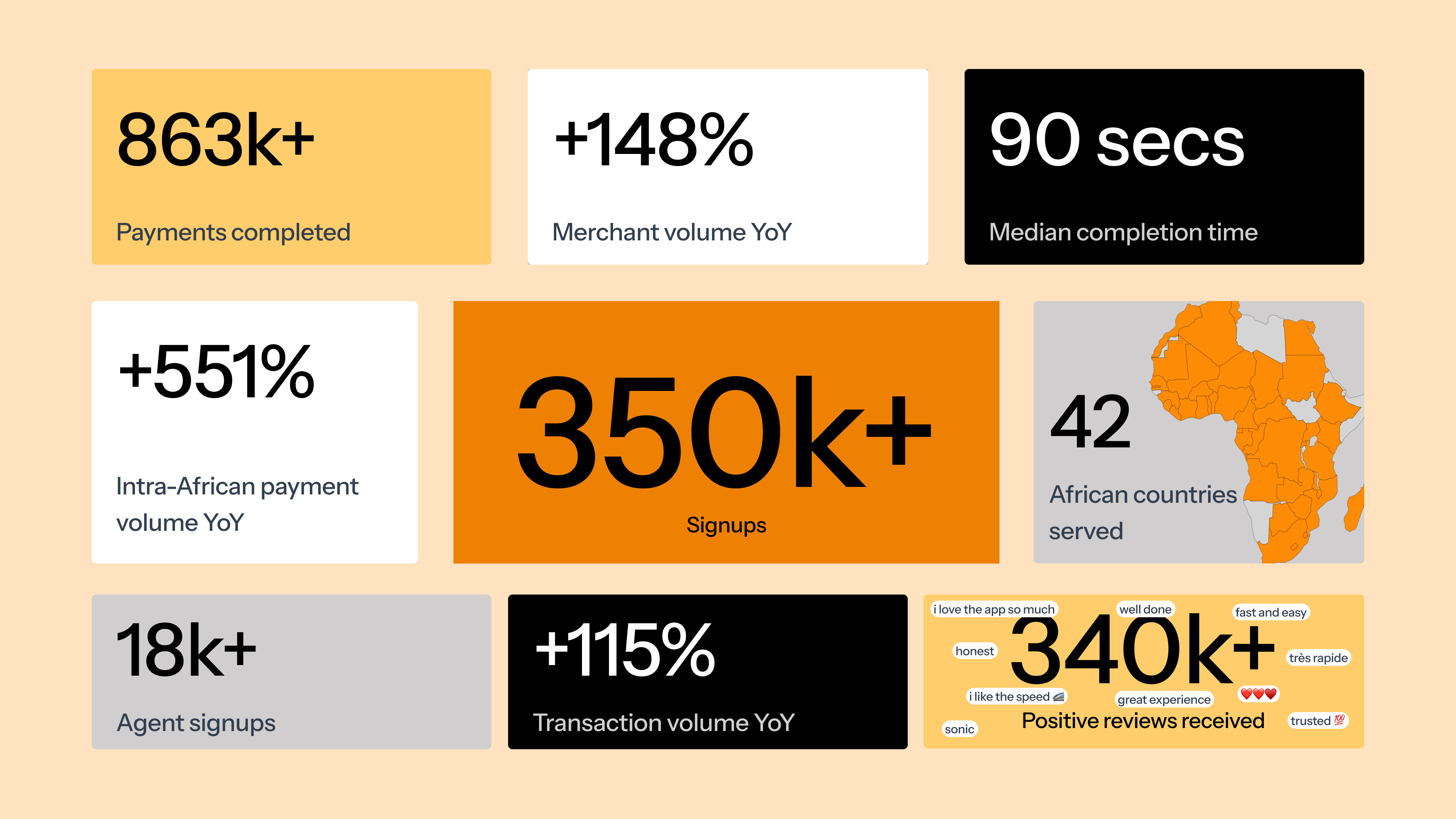

We bet early on building an agent network. Most people assume it's slow, manual, and inefficient, but 18k+ agents across sixteen (16) countries, completing payments in 90 seconds with 340k+ positive reviews say otherwise. This is why we will win:

- Widely available liquidity network: In sixteen (16) countries, instead of prefunding accounts in every currency or heavily relying on PSPs, the agent network gives us deep liquidity on P2P rails. This allows us to minimize dependence on PSPs that can squeeze our margins as things heat up or build competing products themselves.

- Trust at the last mile: Considering the fact that the vast majority of customers we want to reach are either using traditional rails or unbanked entirely, the existing agent networks we're upgrading to stablecoin rails confer an important trust layer that gives us a strong shot at last-mile stablecoin adoption.

- Markets incumbents won't touch: I'm convinced that there are markets that incumbents won't touch. They're either too small, too risky, or too expensive to serve. The agent network allows us to serve these markets with little to no setup costs and a level of affordability, efficiency, and reliability that incumbents won't be able to match.

- Domestic stablecoins: We're already seeing fast-growing interest in the utility that USD-stablecoins provide—fast, affordable, intra-African payments, integration into the global economy, and a hedge against inflation and currency devaluation. As we continue to make progress, I expect us to reach a position of widespread adoption, where we can deploy domestic stablecoins with clear utility for individuals and businesses, thereby mitigating one of the biggest concerns of USD-stablecoin proliferation: dollarization of African economies. Pay for your groceries in aGHS, or your rent in aNGN, or your ticket to Table Mountain in aZAR. Further down the line, we will explore full intra-African settlement in domestic stablecoins, ensuring African sovereignty.

The proof is in the pudding progress

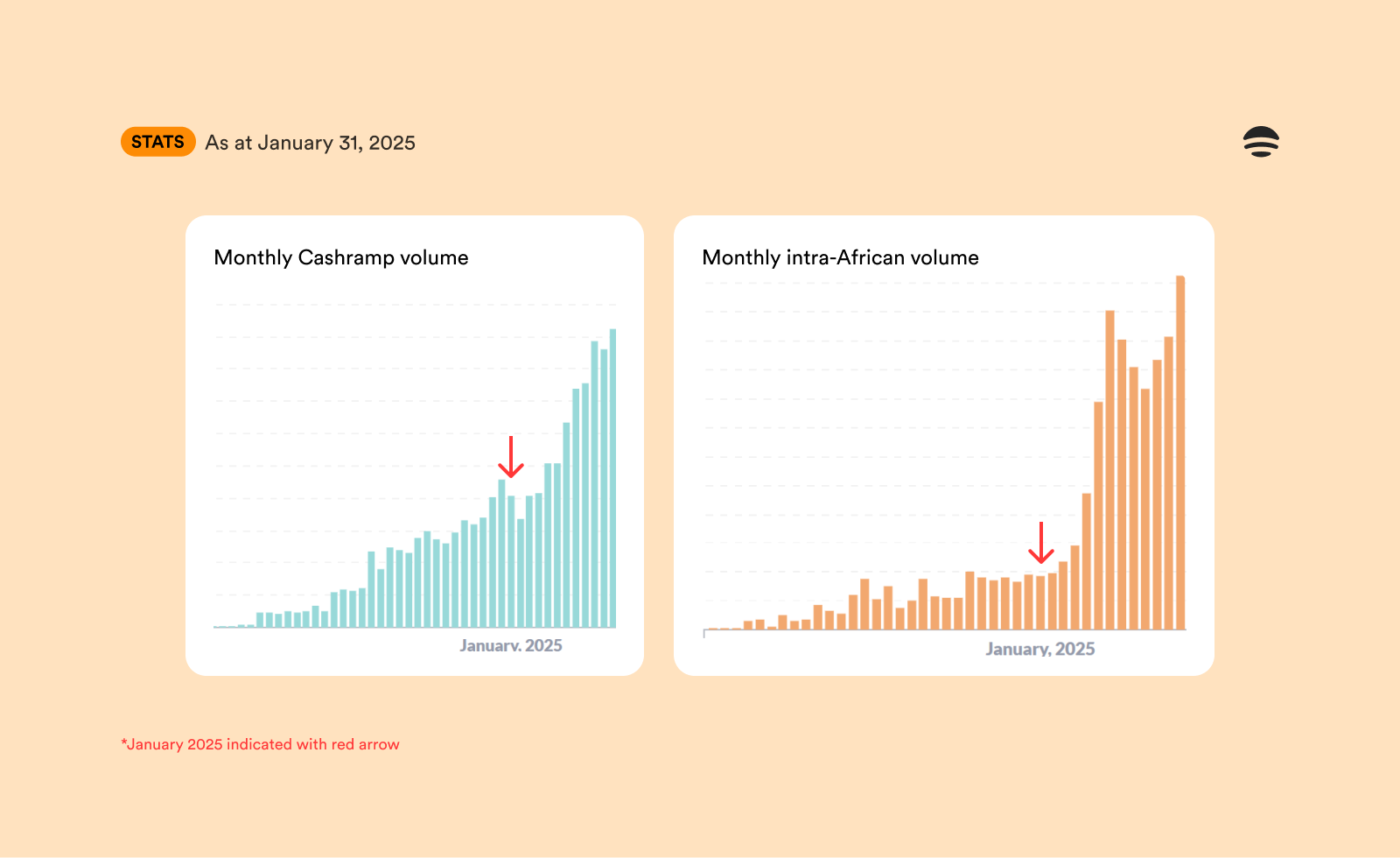

Since my last progress update in October 2024, we've continued to make significant progress that sharpens our conviction. Here are some of the most significant highlights:

- Transaction volume grew by +115% YoY.

- Cross-border payment volume grew by +551% YoY.

- Merchant volume grew by +148% YoY.

- Expanded our agent network into five (5) new countries, bringing our total to sixteen (16): Cote d'Ivoire, Togo, Benin, DR Congo, and Zimbabwe.

- Launched Accrue in Cameroon, ending the year with ~5k users. Cameroon crossed $100k in monthly volume in January—5.6x pre-launch levels.

- Raised a strategic round that deepened our relationship with Tether and Opera.

- We're now the default on-off ramp partner for MiniPay in several markets, and its most widely-available on-off ramp across Africa.

- We crossed 340k+ positive reviews after completed Cashramp transactions.

Crypto is a game-changer; nowhere is that more true than in Africa. It continues to feel like the privilege of a lifetime to spend my time working with my co-founders and the kind, brilliant people at Accrue to make this thesis a reality.